Smart Ways to Save for Your First Home in Trichy

Posted on:

Buying a home is one of life’s biggest milestones. For families in Trichy, this dream is becoming more achievable than ever, thanks to steady growth in the city’s real estate market, affordable lifestyle, and upcoming infrastructure projects. But let’s face it: with property values on the rise, arranging that all-important down payment can feel daunting.

The good news? With a clear plan and smart saving habits, owning your first home in Trichy is well within reach.

Why Planning Your Down Payment Matters

In most Indian cities, buyers are expected to pay 10–25% of the property value upfront as a down payment. Let’s put this into perspective:

- A ₹60 lakh apartment in Chennai would require a down payment of ₹6–15 lakh.

- A ₹40 lakh flat in Trichy (a common price in areas like Woraiyur or Anna Nagar) needs about ₹4–10 lakh upfront.

The gap is significant. This means saving for a home in Trichy is not only realistic but also less financially stressful compared to metros.

But whether it’s ₹4 lakh or ₹10 lakh, arranging that sum still requires planning and discipline. The good news is, with the right strategies, you can build your down payment step by step without feeling the pinch. Here’s how to make it happen:

Setting the Right Budget

The first step is clarity. Ask yourself:

- Do you want a premium apartment near Trichy’s bustling Thillai Nagar?

- Or a family-friendly flat in Anna Nagar, Trichy close to schools and hospitals?

- What’s your approximate budget, and how soon do you plan to buy?

If your goal is to purchase a ₹40 lakh property in three years, you’ll need to save roughly ₹11,000–₹12,000 per month. Even if that feels steep now, start small and increase your savings as your income grows.

Smart Ways to Save for Apartments in Trichy

Homeownership doesn’t mean you stop living well. But small lifestyle tweaks can make a big difference:

- Skip a few restaurant meals each month and you could save ₹2,000–₹3,000.

- Cancel unused OTT subscriptions or gym memberships.

- Use the 24-hour rule before making non-essential purchases.

In Trichy, where the cost of living is already more affordable than metros like Chennai or Bangalore, these adjustments free up even more room in your budget for Property investments.

Best Saving Tools for Buying Properties in Trichy

Traditional saving alone may not be enough to keep up with property price growth. That’s why many Trichy homebuyers turn to:

- SIPs in mutual funds for disciplined monthly investing.

- Fixed deposits or recurring deposits for stable returns.

- Windfall savings - bonuses, tax refunds, or gifts, to boost the home fund.

Just be mindful of credit cards and high-risk investments like crypto or speculative stocks. When saving for long-term goals like properties in Trichy, steady and predictable growth always works better.

For more details on financing, check out our guide on Home loans in Trichy.

Simple Habits to Save Faster for Your Trichy Home

Sometimes, it’s not just what you save, but how you save that makes the difference:

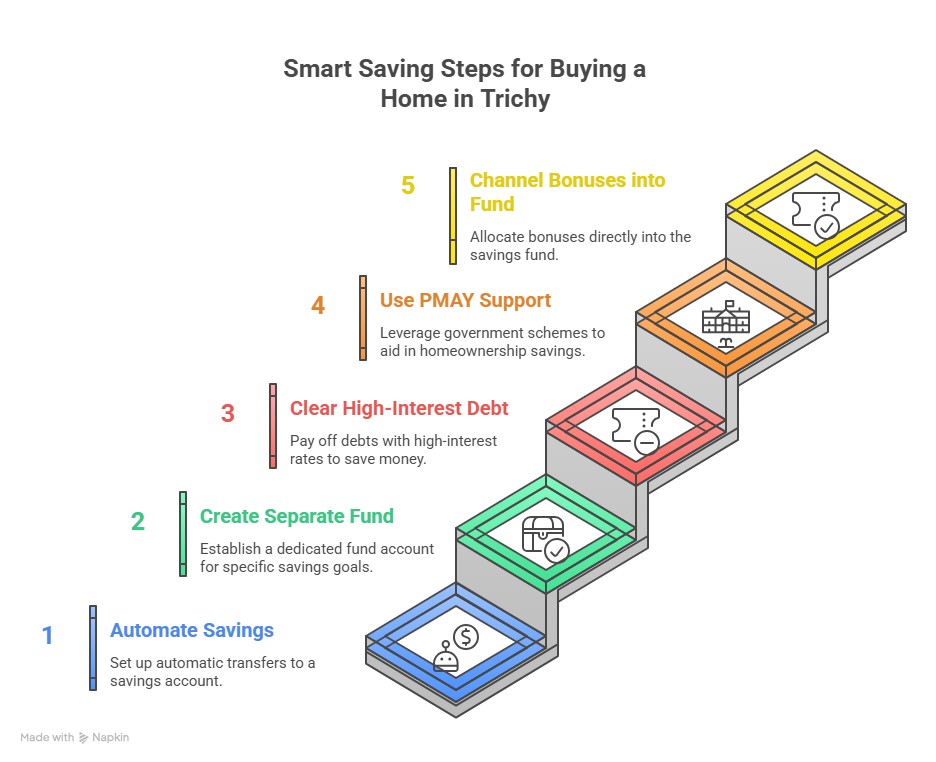

- Automate Your Savings - Set up an auto-debit on salary day for a recurring deposit or SIP so savings happen before you spend.

- Create a Separate Home Fund - Keep your down payment savings in a different account to avoid accidental spending and track progress clearly.

- Clear High-Interest Debt - If you’re juggling credit card dues or personal loans, paying them off first frees up more monthly income for your home fund.

- Use Government Support - Schemes like Pradhan Mantri Awas Yojana (PMAY) can reduce your effective loan burden if you’re eligible, easing the saving pressure.

- Leverage Extra Income - Channel bonuses, tax refunds, or side-income directly into your home fund instead of lifestyle upgrades.

A step-by-step visual guide to saving smartly for your first home in Trichy

Before you take the plunge, it’s also smart to check our Apartment Buying Checklist and Legal Guide for Apartment Buyers.

Trichy’s Market Advantage

Trichy isn’t just cheaper than metros, it’s stable and rewarding. Property prices here have grown at a steady 7–9% annually, and rental yields in areas like Thillai Nagar and Srirangam hover around 3–4%. With average property rates around ₹5,400 per sq.ft, nearly 40% lower than Chennai’s, buyers here enjoy both affordability today and long-term value tomorrow.

Explore more in our blog on Trichy’s Real Estate Growth and the Top Locations to Buy Flats in Trichy.

Final Word: Your Path to Owning a Home in Trichy

Buying a home in Trichy may be your biggest financial decision, but it doesn’t have to feel stressful. With the right mix of planning, saving, and disciplined investing, you can confidently work toward owning your dream home.

More importantly, Trichy’s real estate market offers the perfect balance: affordable entry points, strong growth potential, and a family-friendly lifestyle. Whether you’re a first-time buyer or looking to upgrade, the city is emerging as one of Tamil Nadu’s most reliable and rewarding property destinations.

Start today, and let every small saving bring you one step closer to a home that’s truly yours in Trichy.